Will Mortgage Rates Go Down in 2025? Market Outlook & Trends

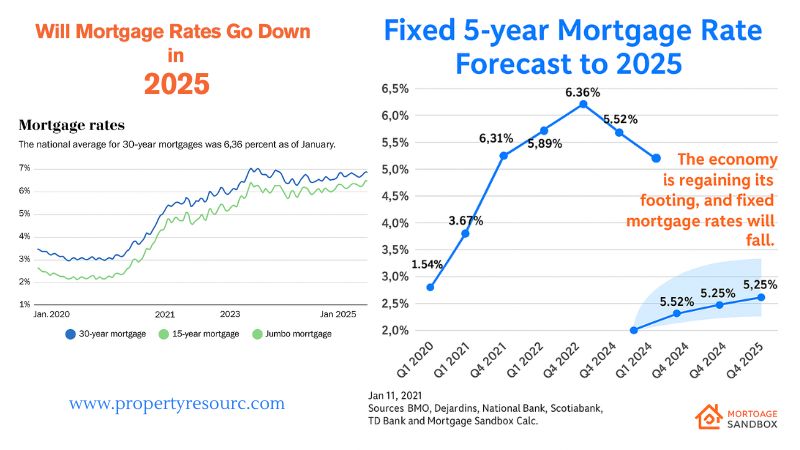

Although forecasts differ among analysts, mortgage rates in 2025 are likely to fall downward.

“Will mortgage rates go down in 2025?” homebuyers and homeowners ask. Experts see probable drops in inflation and economic changes. This essay looks at key elements affecting rates and what borrowers might expect going forward. Industry experts see the following breakdown:

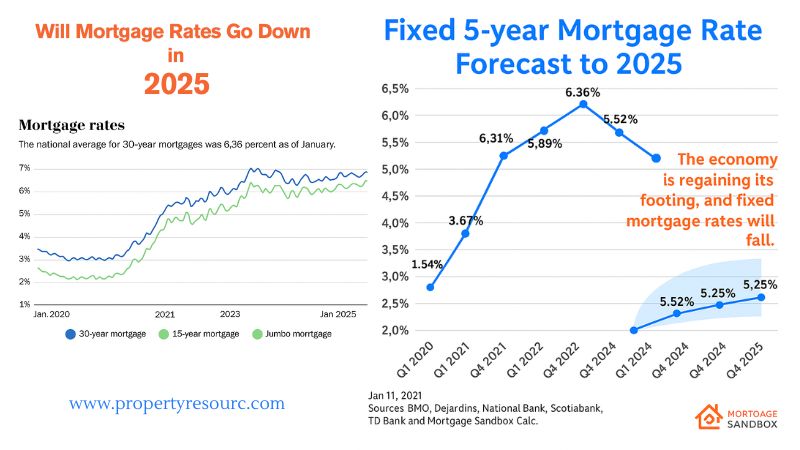

Current State of Mortgage Rates

Mortgage rates have steadily risen in response to growing inflation and aggressive central bank interest rate rises from historic lows in 2020 and 2021. Rates settled in late 2024 but stayed higher than pre-pandemic levels.

Given that higher rates entail heavier monthly payments, buyers still struggle with housing affordability. The following year could see a rate cut if inflation is lowered and monetary policy changes are implemented.

Expert Predictions

- With the Federal Reserve still lowering rates, 30-year fixed mortgage rates in 2025 will average about 6%.

- Driven by declining Fed Funds rates and some narrowing of mortgage rate spreads, mortgage rates will average around 6.6% in 2025 and end at about 6.35% by year-end.

- 30-year fixed mortgage rates start 2025 at over 7.0% and drop somewhat to around 6.0% by year-end.

- For 30-year fixed-rate mortgages, mortgage rates will remain around 6%; for 15-year mortgages, average rates will be 5.75%. Through most of 2025, 15-year rates will average 5.75%.

- Over 2025, 30-year fixed mortgage rates will average 6.75%; rates will stay high because of the cautious posture of the Federal Reserve and global uncertainty.

Factors That Could Lower Mortgage Rates in 2025

1. Federal Reserve Policy & Inflation Trends

Mortgage rates are strongly influenced by Fed interest rate decisions. Should inflation stay close to the 2% objective, rate reductions in 2025 might result in reduced home loan interest rates; quantitative tightening will affect mortgage rates.

Treasury yield: Greater returns on ten-year Treasuries will maintain raised mortgage rates.

2. Economic Slowdown & Recession Risks

Mortgage rates will be affected by strong economic statistics, so they may be kept higher. A slower job market or GDP decline might force the Fed to lower interest rates, thereby reducing borrowing costs. Analysts speculate that if economic growth slows down, mortgage rates might decline as well.

Economic Factors Influencing 2025 Mortgage Rates (H2)

Examining the larger economic picture can help address the issue of “Will mortgage rates go down in 2025?” Interest rate direction will be shaped in part by many significant elements:

• Trends in inflation: Reducing inflation will help cut mortgage rates. Central banks might feel less pressure to keep rates high as inflation cools. Lower inflation often results in lower borrowing rates.

• Federal Reserve Policy: Mortgage rates will be immediately impacted by any interest rate-cutting action taken. Analyses suggest that rate reductions might follow a slowing down of economic development.

• Global Economic Stability: Investor attitudes and long-term interest rates are influenced by geopolitical conflicts and world markets. Stability might help drive reduced mortgage rates.

Many economists are cautiously hopeful that rates may trend down given these factors; substantial changes will rely on data and policy actions.

Housing market: High home prices and limited inventory will influence affordability and mortgage rates.

Will Mortgage Rates Drop Below 6%?

Although rates in 2023–24 exceeded 7%, predictions indicate that if inflation slows down in 2025 mortgage rates might drop to 5–6%. Geopolitical concerns or strong demand, however, may keep rates high.

What Buyers & Homeowners Should Do

1. Lock in Rates if Refinancing Soon

Should rates drop, refinancing a mortgage might save thousands of dollars. Track changes and respond as rates fall.

2. Boost Your Credit Score for Better Bargains

Though averages fall, a better credit score guarantees the lowest rate..

Real Estate Market Trends for 2025 (H3)

Inquiring about mortgage rates in 2025 requires property developments. The housing market keeps changing.

• Inventory Levels: Low housing supply might keep home prices high even if borrowing costs decrease.

• Buyer Demand: Should rates drop, pent-up demand from sidelined consumers might rise, resulting in increased competition.

• Financial Concerns: Though a price increase may balance these advantages, lower mortgage rates might relieve economic problems.

Basically, even if rate reductions offer respite, the housing scene will remain competitive and changing overall.

Guidelines for Householders and Homebuyers

• Buy now or wait: Before deciding, consumers should weigh their financial situation and market environment.

Before refinancing, homeowners should review market trends and assess their break-even point.

• Adjustable-rate mortgages: ARMs might provide purchasers hoping rates drop.

• Rate buydowns: To get better rates, buyers could consider them.

I regretfully am a text-based artificial intelligence; I cannot create pictures. Still, the material above will help you understand the present state of the mortgage rate market and future changes.

Conclusion

Will mortgage rates decrease in 2025? Although economic changes could affect projections, current signs suggest that declines are likely. Purchasers should remain updated and ready for better prices next year.